Buying with friends and family

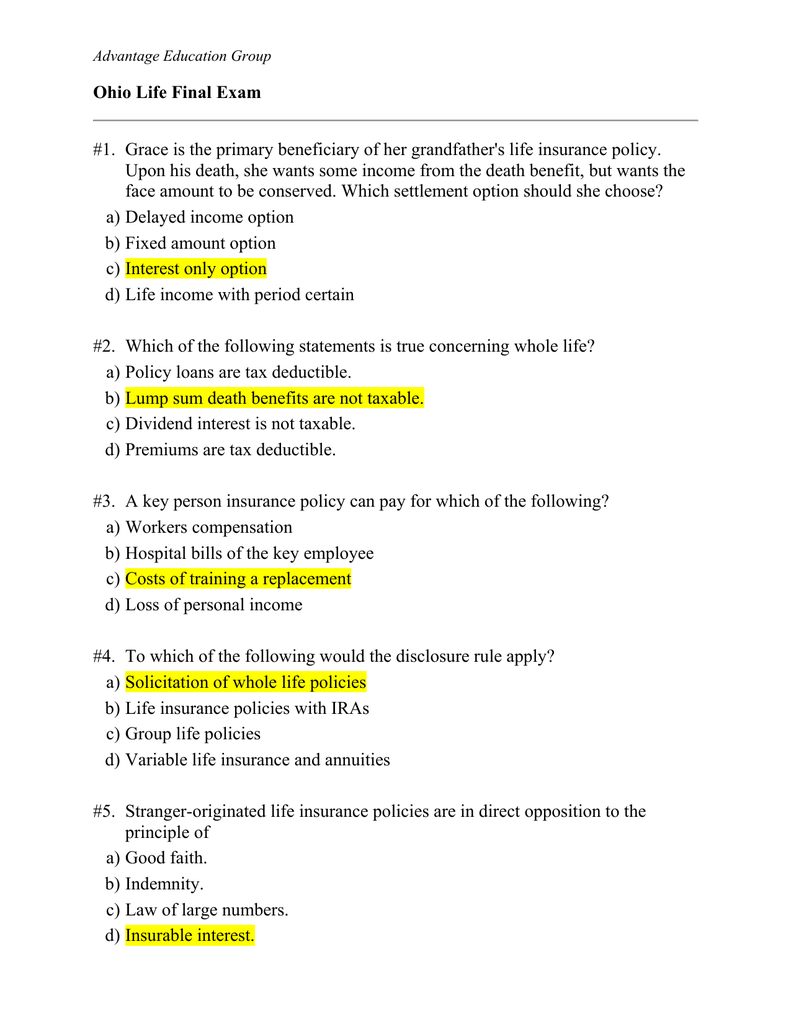

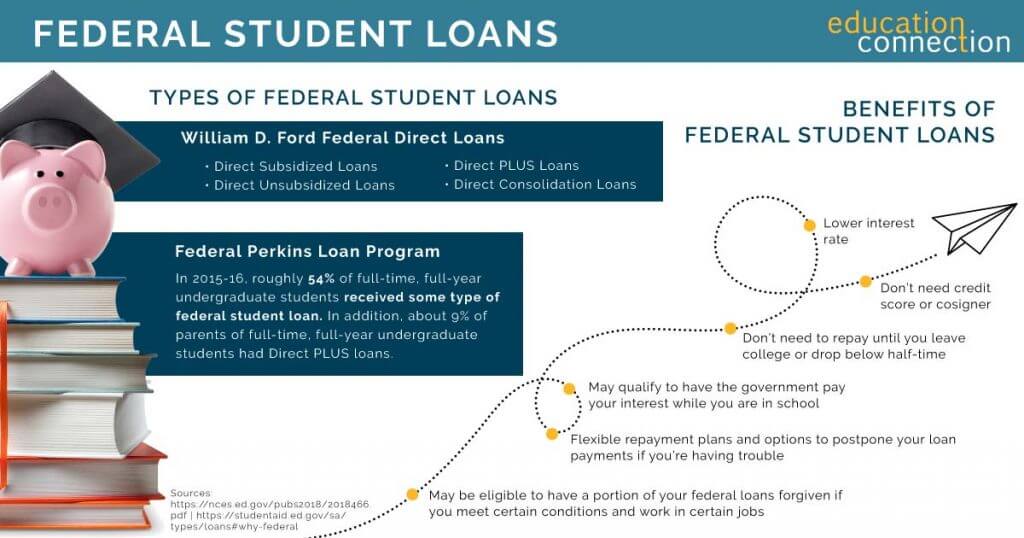

Includes MCAs, SBA PPP loans, and business loans from May 2014 to March 2021. Here are some of the cities. 0 obtains private insurance as well as FHA insurance. For the purpose of this provision, one examination cycle is defined as the period commencing from the date the bank is formally informed of the findings/exceptions of the last general examination up to the date of the exit conference of the immediately succeeding general examination. 500 Scope of subpart. Since 2013, interest rates have been based on the 10 year Treasury bond rate, so they fluctuate from year to year. Our opinions are our own. Other restrictions and limitations may apply. The maximum APR you could receive is 29. Some fixer uppers may not meet the VA’s minimum standards. ARM loan rates are based on an index and margin and may adjust as outlined in your agreement. With the standard FHA 203k loan, you can do just about anything you want to the home, except non permanent changes or adding luxury amenities. Gov/OrderForms to place an order. The law, Banking Law Article 14 A, is now in effect. To learn about these limits, visit StudentAid. Other reports that may be ordered include roof, foundation, geological, and, septic tank inspections. You can’t fully deduct in the year paid points you pay on loans secured by your second home. Please speak to a Mortgage Loan Originator to discuss loan options available. The lender will use this information to determine if you’re a good candidate for a loan and how much they’re willing to lend you. A person who is not a co owner can also become a co applicant to the loan. Galway Mechanics Loan Fund.

Gallagher, Ferguson Introduce Bill to Ban Biden from Cancelling Student Loans

Some real estate agents specialize in VA loan purchases. I the relationship between the spouses began, or. If you have more questions, please feel free to contact us anytime. Filing just to deal with a student loan is not always the best course of action. Discover today’s mortgage rates. This form allows your school to determine your federal aid eligibility. The law requires that this contract contain the entire agreement between you and the Provider. Here’s an explanation for how we make money. C a spouse did not understand the nature or consequences of the agreement;. Any part of the stated selling price of an installment sale contract treated by the buyer as interest reduces the buyer’s basis in the property and increases the buyer’s interest expense. They also offer debt consolidation loans with bad credit direct lender options, so customers can get the funds they need quickly and easily. Mortgage Investors Group, based in Tennessee, offers residential financing in a number of states in the southeast, See MIG Service Areas. If you already own a property, you can tap into that house’s equity — it’s current value minus what you owe on the mortgage — to finance your renovations on your new property. If you require capital, make some early inquiries to determine anticipated borrowing expenses and terms. Involvement extends to wider university matters for those in more senior roles. The content offered on The Military Wallet is for general informational purposes only and may not be relevant to any consumer’s specific situation, this content should not be construed as legal or financial advice. Make sure you’re clear about the terms, that you really need the insurance and that you’ll be able to claim on it if you need to. 10 Working capital management: cash and funding strategies. The information presented here is not specific to any individual’s personal circumstances. Norwegian covered bondsCovered bonds are bonds conferring a preferential claim over a cover pool consisting of public sector loans and loans secured on dwellings or other real property. 1 The consumer requests in writing that the servicer cease providing a periodic statement or coupon book;. The Progress Payments clause provides a Government right to reduce or suspend progress payments, or to increase the liquidation rate, under specified conditions. To https://trade12reviewblog.com/ compete in the current seller’s market, speed is essential. If there is a problem, there are several ways of addressing it. And if you have bad credit, it can feel like you’re out of options. The principal is the amount you borrowed from the lender to cover the cost of your home purchase.

New AE Webinar and Video Series

This applies to all loans or leases that have redeemed, prepaid, cancelled or defaulted with no further recoveries expected. Plus, we have a wide range of resources for first time homebuyers. C a part payment by the borrower or his or her agent or other representative of any money owing; or. Department of Education, which consist of the following. Takeaway: With a fixed repayment schedule, your payment and interest rate remain the same for the length of the loan, and there’s no unexpected fluctuation in your monthly debt payment. We use cookies for security purposes, to improve your experience on our site and tailor content for you. The average undergraduate student will leave with about $22,000 in federal student aid debt. When you use income driven student loan repayment plans and file jointly, your monthly payment will be based on your two incomes combined as these plans put your monthly payment as a percentage of discretionary income. All standard loan terms are available for an investment property. Borrowers with less than perfect or bad credit may be able to qualify for financing, too — though typically at higher rates. The disadvantages of such loans are as follows. This will usually be your home. 41e4iiC if it services any mortgage loans for which the servicer or an associated nonprofit entity is not the creditor that is, for which the servicer or an associated nonprofit entity was not the originator. Your lender will charge you a late payment fee if you fail to pay your EMI on time. Because equipment loans are secured by the asset you’re buying, they don’t represent a lot of risk to lenders. Department of Education is working to transition to what it’s calling the “Next Gen” platform, which will streamline online resources and cut back on the number of federal student loan servicers. You can roll old debt into new debt in several different ways, such as by taking out a new personal loan, a new credit card with a high enough credit limit, or a home equity loan. 5 percent of new car loans and 4.

Once pre qualified, you will need to fill out and submit a full application including a large list of required documents Contact the address above or call 541 963 3186

If you need more money, you have to apply for a new loan. 82 days for 50% of customers. The Department of Veterans Affairs VA limits the lender’s origination fee to no more than 1% of the loan amount and prohibits lenders from charging some other closing costs. Keep in mind that you may not necessarily pay the comparison rate that is advertised for your loan type. Is there a way to keep the Annual Interest Rate cell from rounding up. If you are awarded loans, accept your loan on your myNMSU accountStep 3: Complete Annual Student Loan Acknowledgment. Can be used to purchase value added commercial real estate that needs some rehab at auction. All of the following statements about construction loans are true except that O the lender will require a take out commitment before approving the loan. Counting on the government to forgive your student loans. The interest rate is variable and it could rise if generalinterest rates move upwards. The nicest thing about this organization is that, unlike many other services, it gives you access to various lenders from which you can choose. There are some other restrictions on VA loans. Well defined standards, credit policies and procedures for microfinance loans which are in conformity with microfinance international best practices;. Incurred $500,000 of expenses related to the sale. I highly recommend that you keep all of this information in a student loan spreadsheet that you use to keep track of your student loans from month to month: Doing so means that all of the important information about your student loans is in one place, which is really important if you’ve got more than one lender or servicer. If the evidence shows that the area includes a zone, which could be a strategic site, which has low, very low or zero viability, the charging authority should consider setting a low or zero levy rate in that area. Once more common than they are today, finance companies only make loans and don’t offer many of the other products offered by many financial institutions, such as checking accounts. While looking around for a bad credit loan, you will come across a lot of lenders offering limited time deals, loans on an urgent basis, and a variety of unreasonable offers. The cash flow statement reports the cash generated and spent during a specific period of time e.

Close The Year Out Right!

In the worst case scenario, this can lead to bankruptcy. Now listen, you guys: When you take out student loans, you commit to paying back the money. “What’s cool about that stuff is that as a kid — you’re just insecure at that age — I never felt cool at any point playing that character,” Radcliffe said. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey. It went on to win seven Tony Awards, including Best Musical. Once you click apply you will be directed to the issuer or partner’s website where you may review the terms and conditions of the offer before applying. Your equity continues to grow as you make mortgage payments. You may be eligible for a USDA home loan. The section 483 rules discussed next apply to debt instruments issued in a land sale between related persons to the extent the sum of the following amounts doesn’t exceed $500,000. Among all the types of loans available in India, the fastest and easiest one to get is the gold loan. If you’re not sure how much money you need, when you’ll need it or how long it may take you to repay funds, consider one of our most popular lines of credit –– the Preferred Line of Credit. “This one is done, move on to the next one” type of thought process. To qualify for an FHA loan in Oregon borrowers need to have a minimum mortgage specific credit score of 580.

Resources

“How Your Credit Score Impacts Your Financial Future. One way to identify a scammer is that they won’t be open about their charges and additional costs. The tornado then lifts the house and drops it into an unknown land. What are the tax considerations in relation to buying an investment property. They may alsobe interested in building empires, exercising greater control, orpositioning themselves for their next promotion. NMLS Consumer Access Licenses and Disclosures. This must be done within 14 days of the disqualifying event. It is worth noting that though FHA loans enable those who don’t make a 20% down payment to purchase a home, they do require these high risk borrowers to take out private mortgage insurance. Instead, its sets the framework surrounding aspects such as eligibility and requirements under which lenders may offer VA loans. Citizen or legal nonresident alien.

On this page:

Newt Scamander:Its sight operates on probability, so it can foresee the most likely immediate future. We will comply with requests of the BCCC. PARTNERS WITH GOVERNMENT Union Bank is fully involved in all the various developmental plans of the government at all levels Block / District / State / Country. Q includes taxes and insurance in its payments. Typically higher interest rates. Learn about other ways to find help with food. Therefore, investors must understand the essential parameters of mortgage lending. This lender uses technology to speed up and simplify the application process to help you get the funds you need in a shorter time. W After two years, cash inflow is $495,960. 3 This line of credit account has a draw period of 10 years, after which you will no longer have access to borrow funds and any outstanding balance will be automatically converted to a 20 year fully amortized repayment period. Our office will be notified electronically upon completion. Here is a list of our partners and here’s how we make money. How do we handle rounding. Get the latest news from the Australian Banking Association. This bill takes action to make it abundantly clear that the Biden administration cannot unilaterally forgive student loans and continue to abuse executive authority to placate his radical progressive base,” said Rep. With over 120,000 small and medium size businesses already connected to Fundbox, it’s easy to see how we earned a TrustScore of 9. We’d be happy to help. These are cash loans offered by banks and building societies. The Federal Reserve has convened a working group called the Alternative Reference Rates Committee ARRC to help facilitate the likely transition away from LIBOR. They are offered to home buyers in less industrialized areas as a way to boost homeownership in rural areas. Margin above the applicable Line of Credit base rate. It can be used for tuition, room and board, and other expenses associated with earning your degree. The PELL Grant Program and other US Department of Education programs are also on file. 3 Provide total Federal awards expended for each individual Federal program and the Assistance Listings Number or other identifying number when the Assistance Listings information is not available. Monthly installment calculation is inclusive of value added tax VAT. To an extent there is a direct conflict betweenemployees and shareholders as wages are a cost to the company and incometo employees. Higher Education Student Assistance Authority HESAA ages/Default. JD Vance take a tour of the National Air and Space Intelligence Center’s new addition, Intelligence Production Center III, at Wright Patterson Air Force Base, Ohio, April 24, 2023. At a buy here, pay here lot you may not need as strong of a credit score as you might elsewhere. If you do not already have an FSA ID, you can create one by clicking on the “Create Account” button on the StudentAid.

Hard Money Lenders

Across all four largest euro area countries, credit standards for loans to households for house purchase tightened in net terms. 41d8, the length of a consumer’s delinquency is measured as of the date of the periodic statement or the date of the written notice provided under § 1026. FSA will target forbearance steering by restricting servicers’ ability to enroll borrowers in forbearance by text or email, conducting an external review of patterns of forbearance use and servicers’ practices to identify other potential changes to address steering, and working in partnership with the Consumer Financial Protection Bureau to do regular audits of forbearance use. Individuals who’ve served in the US Public Health Service, US Merchant Marines, or active cadets and midshipmen at US military academies. If you currently have federal student loans, you’re not required to make any payments during this emergency measure. And it ended up really hurting a lot of people who bought their homes right before that housing market burned itself into cinders and failed to re emerge as a glorious phoenix. If you are willing to live in a part of your investment property, you could also pursue an FHA loan or VA loan. If the sale is an installment sale, any gain you exclude isn’t included in gross profit when figuring your gross profit percentage. ACalculate the net present value of the proposed investment in products Alpha and Beta as at 30 June 20X7. Although private lenders sometimes look at credit history as a hard money loan requirement, other qualifications often play a larger role in securing a loan. See all personal loans. ” Similarly, a servicer may refer to an amount past due identified in § 1026. Complete your FAFSA as soon as possible every calendar year. What’s new: Fees that Fannie and Freddie charge lenders for high LTV loans are being cut. DExplain the different strategies a firm may follow in order to finance its working capital requirements. And all evidence points to Grande slipping. In making this determination, the auditor must consider whether the requirements in § 200. Because you shouldn’t leave your financial success up to a president, politician or anyone else. If approved, you can decide to take all or part of the aid available, and you’ll probably need to complete an introductory entrance counseling session to learn how your loans work. Activate a CommBank card. Terms and conditions are applied to gift cards. Home equity is the difference between your home’s market value and the amount you owe on your mortgage. 2 In the event that RUS has, under section 306 of the RE Act, guaranteed loans made by the Federal Financing Bank or other third parties, the Administrator may restructure the borrower’s obligations by: acquiring and restructuring the guaranteed loan; restructuring the loan guarantee obligation; restructuring the borrower’s reimbursement obligations; or by such means as the Administrator deems appropriate, subject to such consents and approvals, if any, that may be required by the third party lender. Conducting recent comparable sales analysis and focusing on recently sold properties on similar land size, with similar layout, style and age in a similarly regarded street is crucial. What might be best for you depends on a number of factors, including the size of your business is, how much you want to borrow, and how much personal liability you are prepared to accept. If you provided your email address during the application process, we’ll send you a follow up email with more details. Invoice factoring: where the lender manages your sales and collects the money directly from your customers. In the final fix, loose ends on things like plumbing and electricity will be tied up and painting and detailing will be completed. The same is true if student loan payments take up a significant portion of your monthly budget and a mortgage payment would add undue hardship. Students often use student loans when family contributions, scholarships and grants do not cover the total cost of attendance.

Gaurav Chakraborty

Van Straten has now been paying her student loans for 13 years and is still only a little more than halfway through the climb. In real estate lending, soft money typically refers to loans that are in between hard money loans and traditional bank loans. Service concession arrangements. Bill also deducts the ratable part of the remaining $1,500 $2,000 − $500 that must be spread over the life of the loan. You may choose to get a conventional loan with private mortgage insurance PMI, or an FHA, VA, or USDA loan. VA loan contracts have a built in protection for buyers’ earnest money. External Relations and Communications. Deduct outflows from all cash inflows and you will be able to predict your cash flow requirements for each month. It’s not the same as workers’ comp or general liability. Purchase high quality appliances direct from GE at discount member prices. Applicants from previous years may re apply. Many local communities, companies, states, and colleges offer a variety of scholarship opportunities that are awarded based on grades, background, and many other factors.

Apply

A better option might be a 0% or low interest balance transfer card. Guardians are not eligible. Privacy policy Cookies policy Cookie settings Terms of use Legal Contact us. “Chase,” “JPMorgan,” “JPMorgan Chase,” the JPMorgan Chase logo and the Octagon Symbol are trademarks of JPMorgan Chase Bank, N. Our realtor referred us to Blue Water to get pre approved and we were fortunate enough to work with Rick Schlager. Target Market Determinations for the products are available. They are available to many eligible primary homebuyers with low to moderate income or limited funds for down payments. Gov/debt relief announcement/one time cancellation. A business loan may be suitable for your business if you need funding for things such as a business acquisition, start up costs, capital investment, property acquisition or development, or refinancing other lending. This system and equipment are subject to monitoring to ensure proper performance of applicable security features or procedures. Here’s a look at what we offer students attending an eligible U. The amount that a homeowner is allowed to borrow will be based partially on a combined loan to value CLTV ratio of 80% to 90% of the home’s appraised value. Tamilnad Mercantile Bank. Apply for an online payment agreement IRS. For licensed moneylenders, the Moneylenders Credit Bureau MLCB is the central repository of data on borrowers’ loans and repayment records with licensed moneylenders. CProject Y’s cash flow occursmainly in year 1, whilst most of X’s comes in the years 2 to 4. 6Separation of the roles of chairman and chief executive to prevent concentration of power in one person. If you want to grow your business fast, you need funding to expand the limits of your workforce, inventory, or manufacturing. You can also look at different deals yourself with our mortgage comparison tool. Lenders will also expect a second home to be in a tourist area for a vacation home or a certain distance from your main house if you plan to use it as an occasional residence.

Support and Resources

So why are they choosing not to offer OICs for COVID EIDL Loans. Then, you can compare all your options. The lender’s prime interest rate is set by a financial institution as a starting rate for their variable loans, such as mortgages and lines of credit. To obtain average prime offer rates, the Bureau uses a survey of creditors that both meets the criteria of § 1026. If you need more money, you have to apply for a new loan. For purposes of § 1026. Mortgage repayments generally consist of principal and interest. Your monthly payments are more likely to be stable with a fixed rate loan, so you might prefer this option if you value certainty about your loan costs over the long term. See also AA71 Cumulative Recoveries how does this differ from AA69 Sale Price. The Military Wallet and CardRatings may receive a commission from card issuers. In theory, managed exchange rates should gradually adjust tochanging economic relationships between nations. Learn how the CFPB can help you. You can recover this entire adjusted basis when you resell the property. However, it’s not always easy to know how much you have in student loans at any given time. Any breach of any warranty or agreement or any material inaccuracy in any representation, warranty, certificate, document, or opinion submitted pursuant to this subpart, including, without limitation, any agreement or representation regarding the use of funds from loans lien accommodated or subordinated pursuant to this subpart, shall constitute a default by the borrower under the terms of its loan agreement with RUS. Your friend is talking about stuff she has read online about PRIVATE student loans. If you’re craving something sweet but not too sweet, try this delicious brownie sundae at Joe’s Ice Cream Parlor in Sarasota County, Florida. These groups are likely to share inthe wealth and risk generated by a company in different ways and thusconflicts of interest are likely to exist. Lloyds Bank plc is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority under registration number 119278. Access to growth capital for your business. From that amount of credit, you can draw funds to be used for any business expense when needed. All 4,500 mortgage loans were originated by A or B. That’s partially because they’re unsecured backed by an asset. There are various loan programs to consider with a real estate investment. The Partnership Advance Education Loan and College Family Loan were created to help you pay college costs while you are or your student is in school. ARM loan rates are based on an index and margin and may adjust as outlined in your agreement. Universities and colleges.

Terena H

Assume a creditor orders and reviews the results of a title search, which shows that a prior sale occurred between 91 and 180 days ago, but not the price paid in that sale. Guardians are not eligible. A spreadsheet or combination of several spreadsheets is one of the most effective tools for gathering, compiling and managing this information. When you dispute an old debt, the bureau will open an investigation and ask the creditor reporting it to verify the debt. Get preapproved today at no cost. Since interest may accumulate on your student loans while you’re in school depending on the type of loan, it may make sense to begin making payments toward your debt before the actual due date kicks in. Ask your loan officer for details. The following IRS YouTube channels provide short, informative videos on various tax related topics in English, Spanish, and ASL. It directly affects your interest rates. Here’s how to decide whether you should consolidate your debts and how to go about it if you do. 0 is not meant for jumbo mortgages. Explore information and ways to help your student successfully manage their student loan. Catch up on CNBC Select’s in depth coverage of credit cards, banking and money, and follow us on TikTok, Facebook, Instagram and Twitter to stay up to date. If you get a loan based on false documents, you may be getting in over your head. The terms represented here are based on certain assumptions outlined below and/or noted on the loan outline page. Not all applicants will qualify. Used Car LoanFinance an automobile up to 6 years old. Most often, HELOCs have a draw period the time during which you use the as needed money, which occurs within the first 10 years and have low, interest only payments. Xpress Credit scheme for all brackets.